The New Corporate Governance in Theory and Practice

Free download. Book file PDF easily for everyone and every device. You can download and read online The New Corporate Governance in Theory and Practice file PDF Book only if you are registered here. And also you can download or read online all Book PDF file that related with The New Corporate Governance in Theory and Practice book. Happy reading The New Corporate Governance in Theory and Practice Bookeveryone. Download file Free Book PDF The New Corporate Governance in Theory and Practice at Complete PDF Library. This Book have some digital formats such us :paperbook, ebook, kindle, epub, fb2 and another formats. Here is The CompletePDF Book Library. It's free to register here to get Book file PDF The New Corporate Governance in Theory and Practice Pocket Guide.

Contents:

Email address for updates.

My profile My library Metrics Alerts. Sign in.

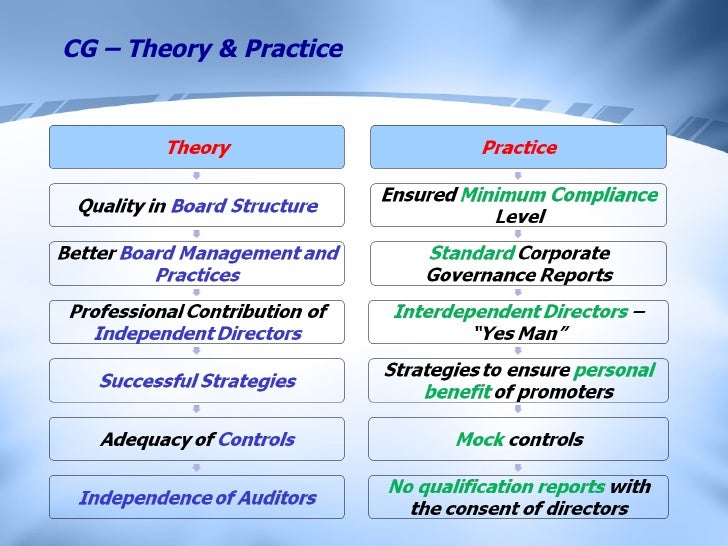

Forty years ago, managerialism dominated corporate governance. In both theory and practice, a team of senior managers ran the corporation. Forty years ago, managerialism dominated corporate governance. In both theory and practice, a team of senior managers ran the corporation with little or no.

Get my own profile Cited by View all All Since Citations h-index 49 32 iindex 84 Verified email at law. Articles Cited by.

Corporate Governance and Sustainability: Challenges for Theory and Practice

Articles 1—20 Show more. Help Privacy Terms.

UL Rev. Director primacy and shareholder disempowerment SM Bainbridge Harv.

- chapter and author info.

- About Conference.

- A Virginia Woolf Chronology.

- International conference New Challenges in Corporate Governance: Theory and Practice.

- Race Rebels: Culture, Politics, and the Black Working Class.

- Performance Politics and the British Voter.

- Supporting Air and Space Expeditionary Forces: Lessons from Operation Iraqi Freedom.

The business judgment rule as abstention doctrine SM Bainbridge Vand. Why a board-group decisionmaking in corporate governance SM Bainbridge Vand.

As explained in Chapter 1 below, director primacy claims this is exactly backwards— directors hire factors of production, not vice versa. Third, director conduct is constrained by an active market for corporate control, ever-rising rates of shareholder litigation, and, some say, activist shareholders. Mike, of course, is not to be blamed for any misuses to which I have put his work here or elsewhere. Managerialism may have fallen out of favor as a normative theory of corporate governance, but it remains the work-a-day world reality. Accordingly, the concept of team production is simply inapt with respect to the large public corporations with which Blair and Stout are concerned. The drafters of the Model Business Corporation Act tell us that the corporation code of every state but one Missouri, whose code is oddly silent have some such formulation.

Abolishing veil piercing SM Bainbridge J. Community and statism: a conservative contractarian critique of progressive corporate law scholarship SM Bainbridge Cornell L.

- The Voice.

- E. M. Forster: Centenary Revaluations.

- International conference “New Challenges in Corporate Governance: Theory and Practice”.

- Dialogue: A Socratic Dialogue on the Art of Writing Dialogue in Fiction (Elements of Fiction Writing).

- Omiyage. Handmade Gifts from Fabric in the Japanese Tradition.

- New Corporate Governance in Theory and Practice - Oxford Scholarship.

Interpreting nonshareholder constituency statutes SM Bainbridge Pepp. Like coffee it seems to come in a bewildering number of varieties. Some politicians like it 'responsible' others 'moral' and still others 'popular'.

- Molecular Cloning: A Laboratory Manual.

- Corporate Governance: Theory and Practice (Palgrave Finance).

- Shop with confidence.

- Down and Out, on the Road: The Homeless in American History.

While some argue that it is time for shareholders to wield real power, others feel that that certain shareholders, notably hedge funds should sit on their hands, at least if they have bought shares after a takeover has been announced. Out on the streets the tents of the "occupy" protectors may be under threat but many are sympathetic to the view that bankers and board members have been rewarded for taking too many risks with other people's money.

Corporate Governance in Banking and Investor Protection

In Corporate Governance: Theory and Practice , Dr Carol Padgett , a lecturer in finance at Henley Business School's ICMA Centre, explores these issues, considering why shareholders may not see themselves as owners of companies and examining new regulation designed to change this view. This new book covers a variety of other governance topics including directors' remuneration, using a wealth of examples from companies around the world. It is comprehensive and thorough in its coverage of an important and expanding topic.